In April 2022 (sometime around April 25th), Elon Musk, the founder of Tesla, SpaceX, and one of the people backing OpenAI, announced that he would buy Twitter. The deal was valued at USD 44 billion.

This valuation would give existing stock holders a 38% premium on the last closing price.

What is premium on share price?

Suppose a stock was traded at 100 rs on Monday evening. On Monday night, an investor said that they are going to buy the company at 138 rs per share. This price is 38% more than the closing price of 100 rs. This is exactly what happened with Twitter.

Obviously, Twitter and the stock market were both very happy because of this.

Following the announcement, Elon Musk asked Twitter for details of bots, spam, and fake accounts on Twitter.

Twitter refused to provide this information. They said that this was not part of the things Musk asked for before finalising the deal. This was not part of due diligence.

What is due diligence?

Suppose you want to buy brinjal/eggplant. You can either order it online, or you can go to the store. Let’s say you go to the store. There, before buying, you check the brinjal by making sure that the skin is fresh and not wrinkled, the piece is not squishy, it is reasonably firm. This process of checking what you are about to buy is called due diligence. We do it buying vegetables, and investors do it before investing in companies.

After talking to Twitter multiple times, on July 8th, Musk announced that he will not be going ahead with the deal.

Twitter stocks fell 6% after Musk’s announcement.

What happens now?

Twitter has announced that it will take the legal route to force Musk to complete the deal.

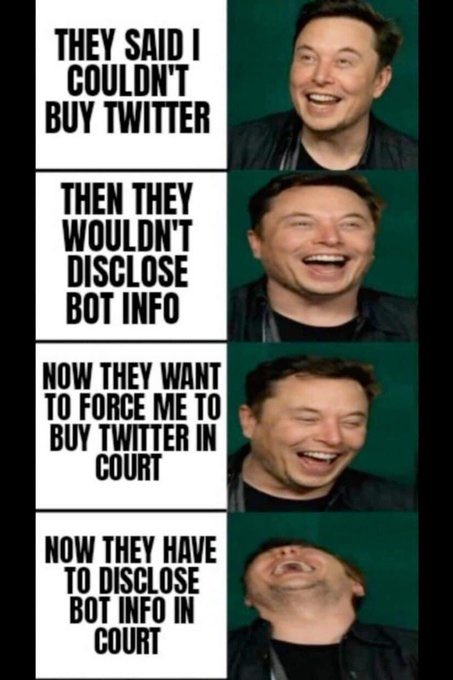

Elon Musk responded by posting the following meme on his Twitter:

Elon Musk Meme in July 2022 on the Twitter takeover legal battle

The matter is likely to be contested in court. This is a developing story.